Introducing: Trifecta Stocks

This publication will primarily focus on Cheap, Sound & Rewarding stocks.

This publication will primarily focus on Trifecta stocks that are Cheap, Sound & Rewarding. I believe this Trifecta is a forcing function towards high batting averages and high CAGRs.

I seek to primarily publish those ideas that are high conviction on both Cheap & Sound.

In terms of Rewarding, I mean Capital Returns (buybacks, tenders, dividends, special dividends). In the context of being a Cheap & Sound stock, capital returns act as a forcing function to ensure the stock is Rewarding (if not in the short-term, the long-term reward is magnified through larger accretion). My evaluation of “Rewarding” will be based on either

current actions and historical rational capital allocation (numbers based)

or, in the absence of present capital returns, intelligent speculation on capital returns inflecting soon (e.g. management track record, management quotes, (evolving) incentives towards returns such as pressure or remuneration etc)

There has to be an angle of either high current returns, or returns inflecting upward soon.

With conviction “Cheap” I mean: low price versus my estimate of value (and the certainty of this being the case has to be reasonably high)

With conviction “Sound” I mean: a reasonable combination of “Quality” management and/or business. I won’t be very picky to have both at the same time, but “Overall” Quality/Soundness has to be at least “average”, and the conviction that this is the case has to be reasonably high.

That’s it. As you will soon find out, I tend to have an obsession with buying back cash/value for less than said cash/value. Let’s go hunting for Trifecta Stocks!

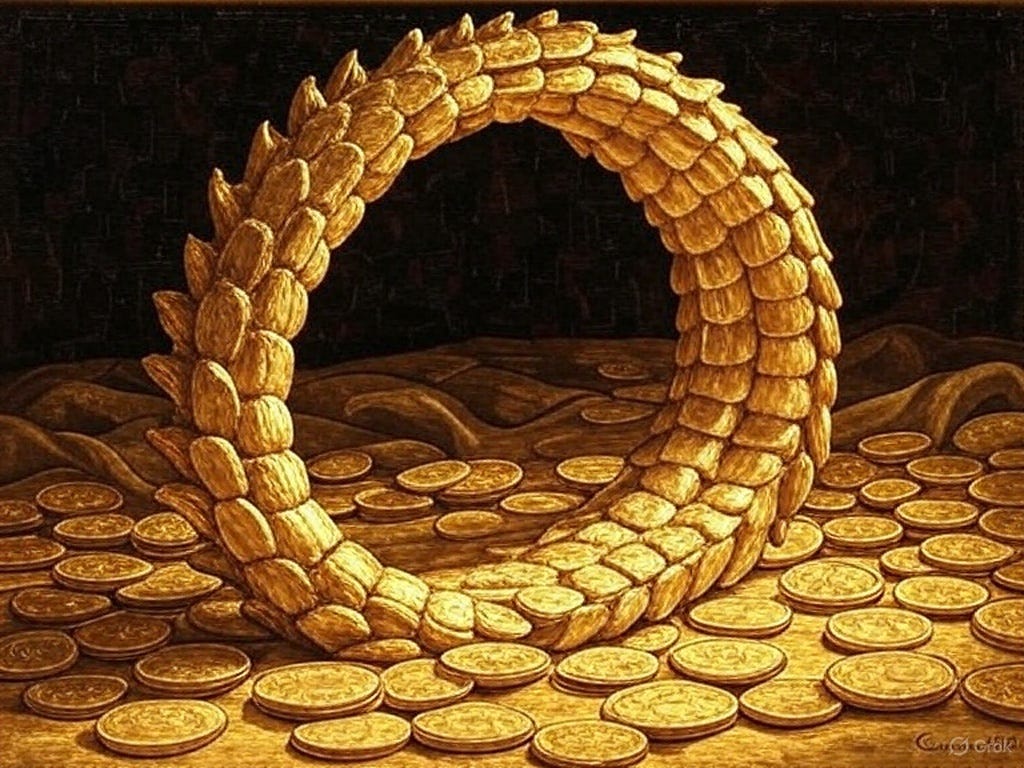

The ouroboros is an ancient symbol of a serpent or dragon eating its own tail. Our ‘money ouroboros’ (thanks Grok) will symbolize the forcing function of the buyback mechanism, and what we hunt for: Cheap, Sound & Rewarding.

Postscript

How Value Realization Has Changed (per David Einhorn Q1 2024):

Traditional Value Investing

Investors bought undervalued stocks and waited for the market to recognize their value.

Returns came through price appreciation as the market re-rated the stock.

The process relied on capital flows and market participants responding to fundamentals.

Einhorn’s Current Approach

Focuses on companies that return capital directly to shareholders via dividends and share buybacks.

Returns are generated from the company itself, regardless of whether the market re-rates the stock.

Capital returns (dividends, buybacks) now act as the primary “forcing function” for value realization, rather than relying on mean reversion.

Welcome to substack. Looks promising!